FinFloh

2024-02-23T08:01:00+00:00

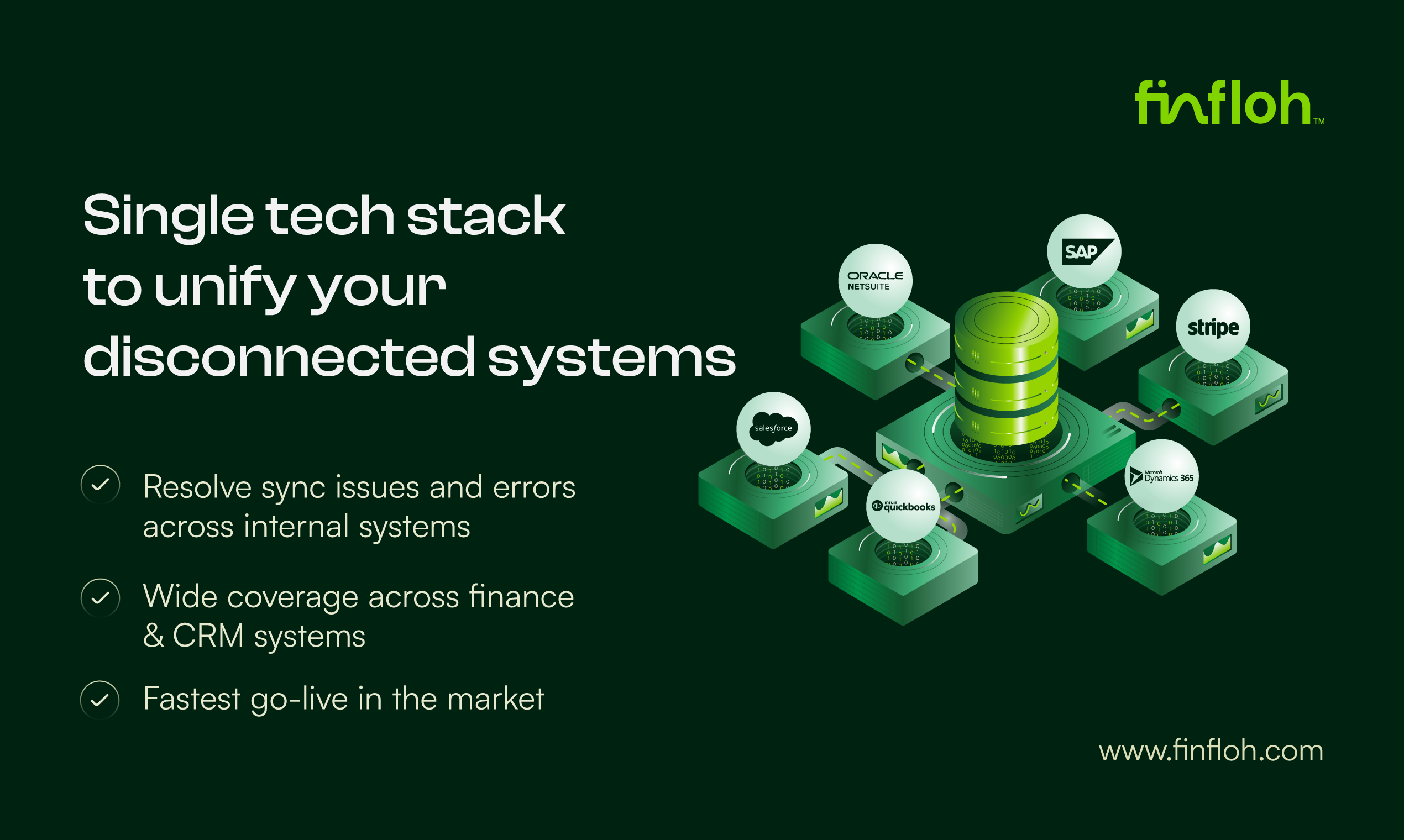

Key Features of FinFloh

- 1

Automate collection follow-ups

- 2

Cash application

- 3

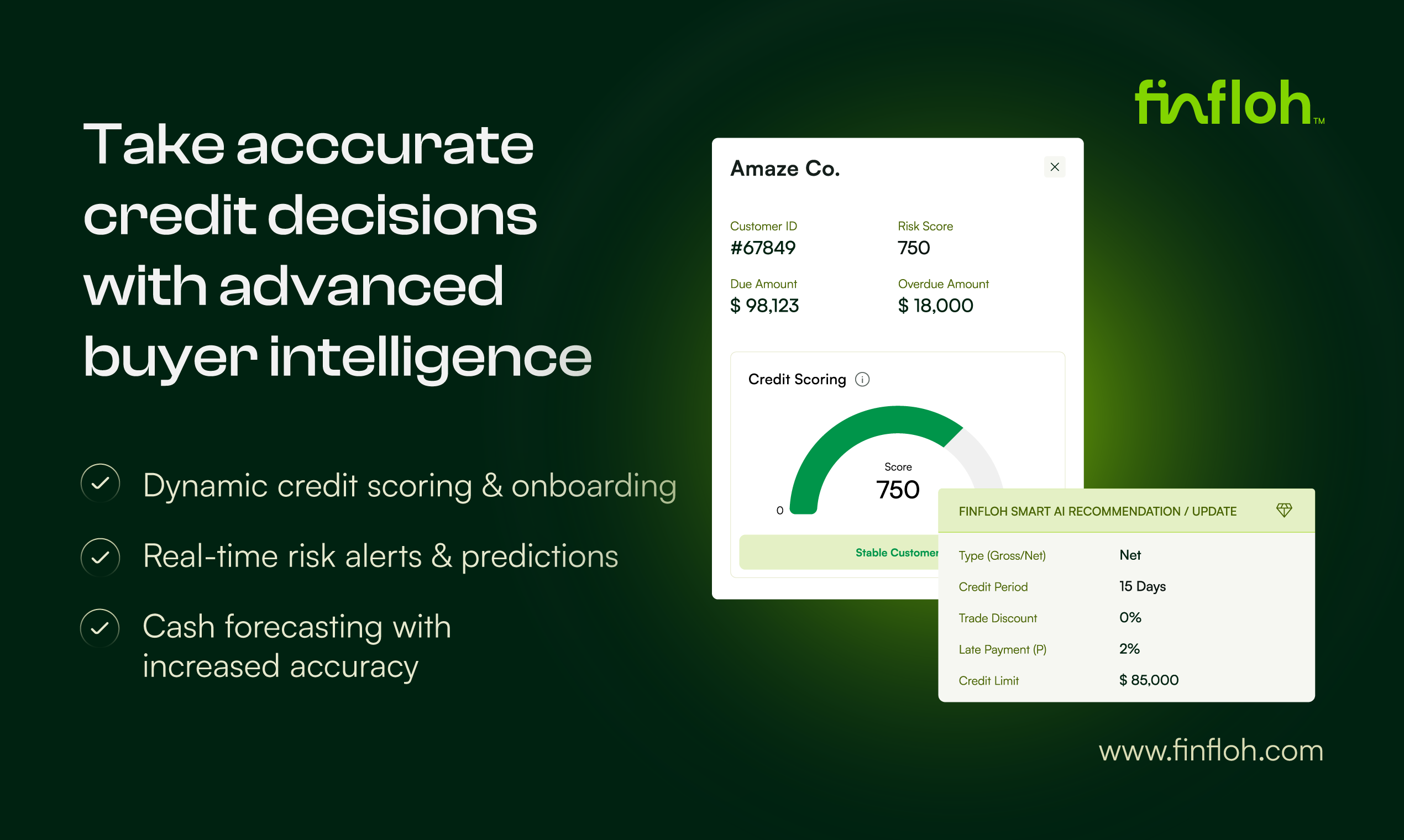

Cash forecasting

- 4

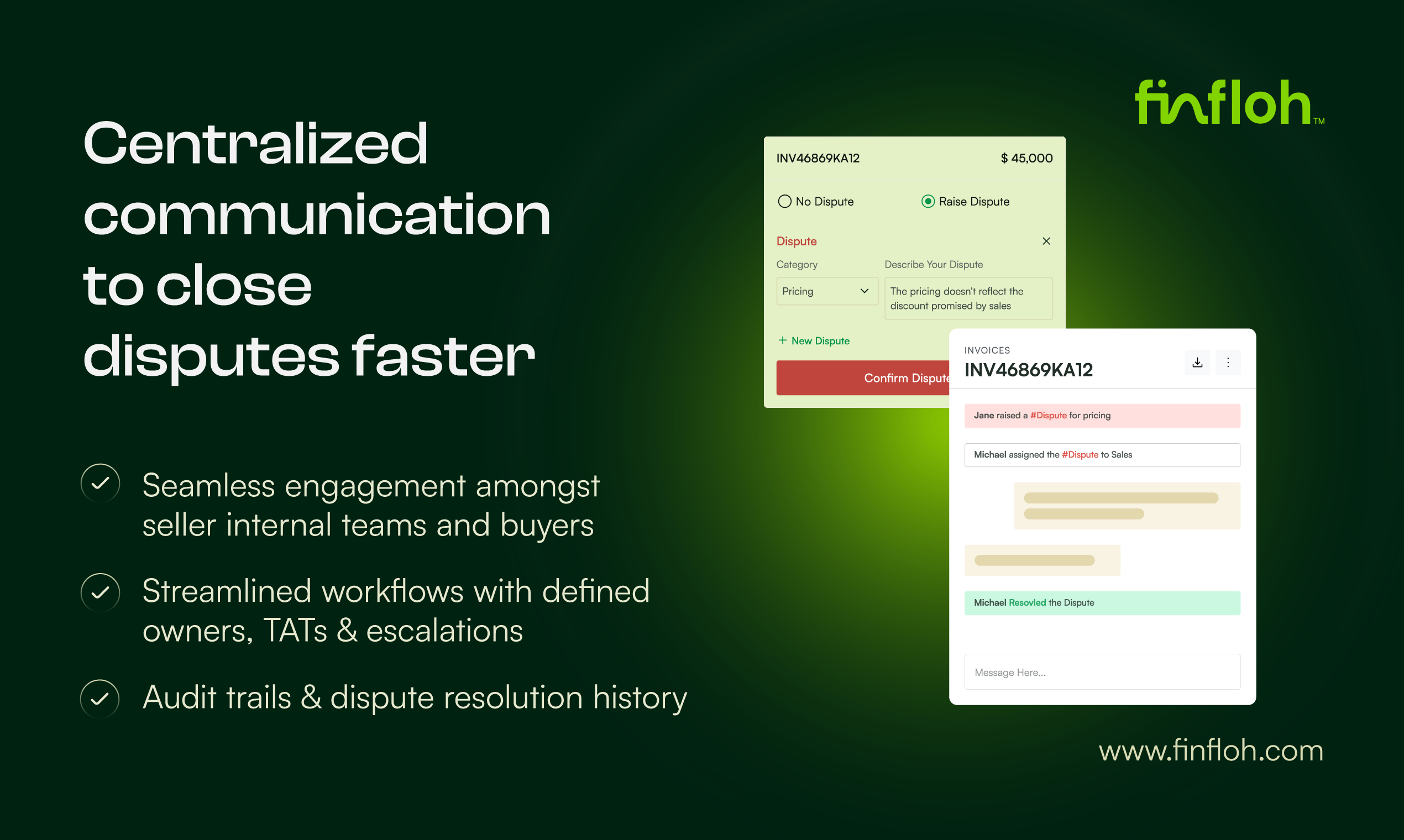

Invoice management with AI-driven customer workflows

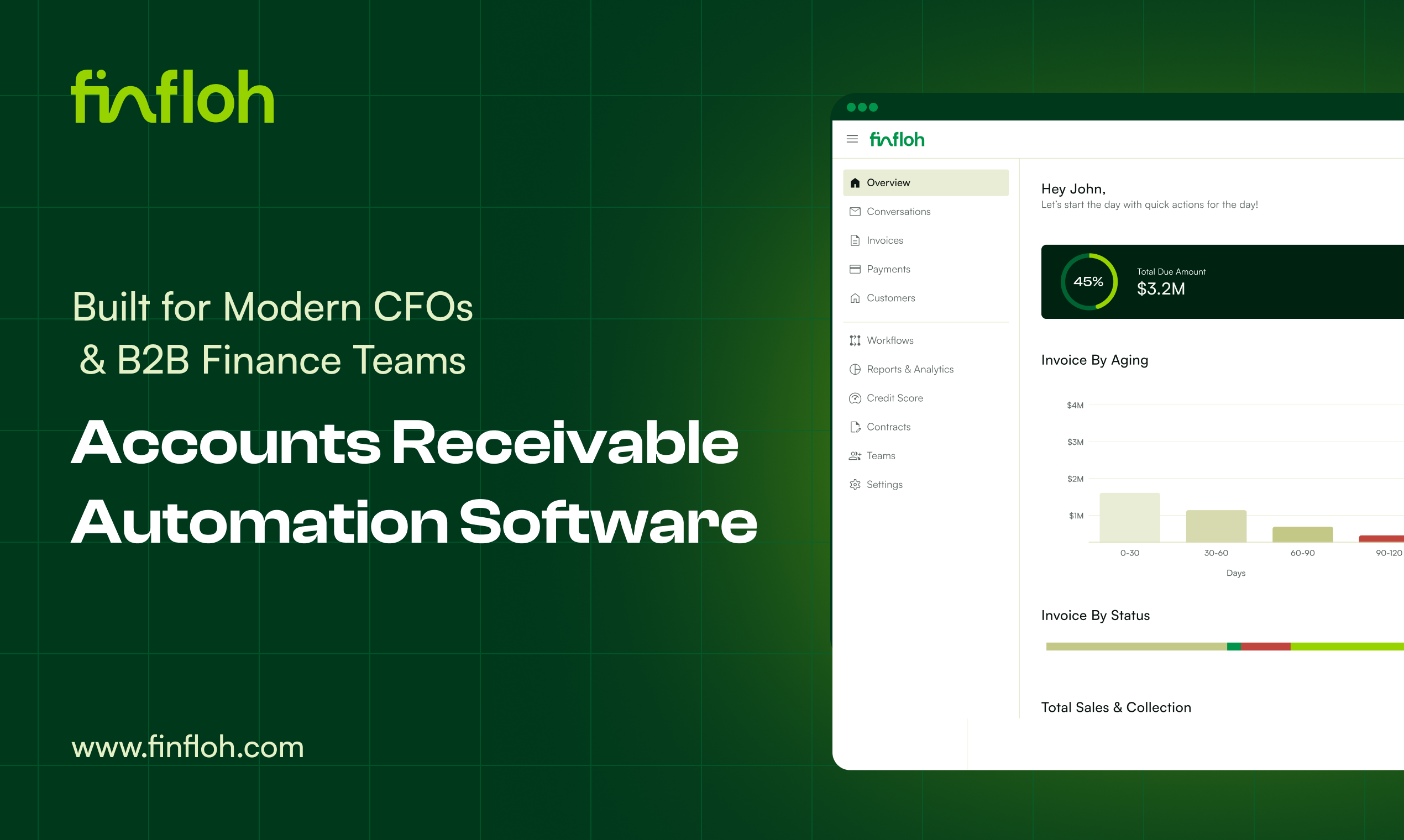

Target Users of FinFloh

- 1

CFOs

- 2

finance teams

- 3

accounting professionals

- 4

financial managers

- 5

business owners

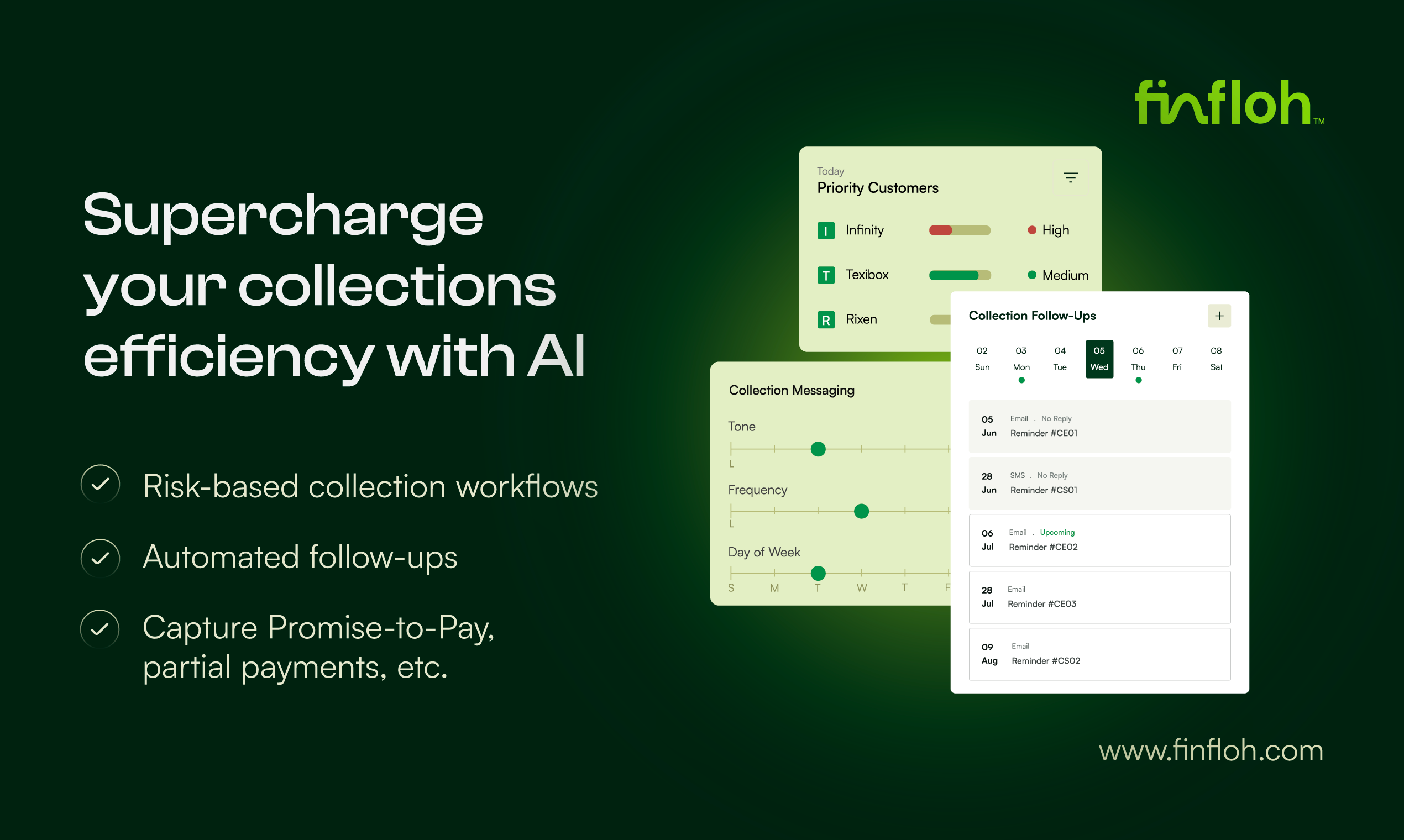

Target User Scenes of FinFloh

- 1

As a CFO, I want to automate collection follow-ups so that I can improve cash flow

- 2

As a finance team member, I want to automate cash application to save time and reduce errors

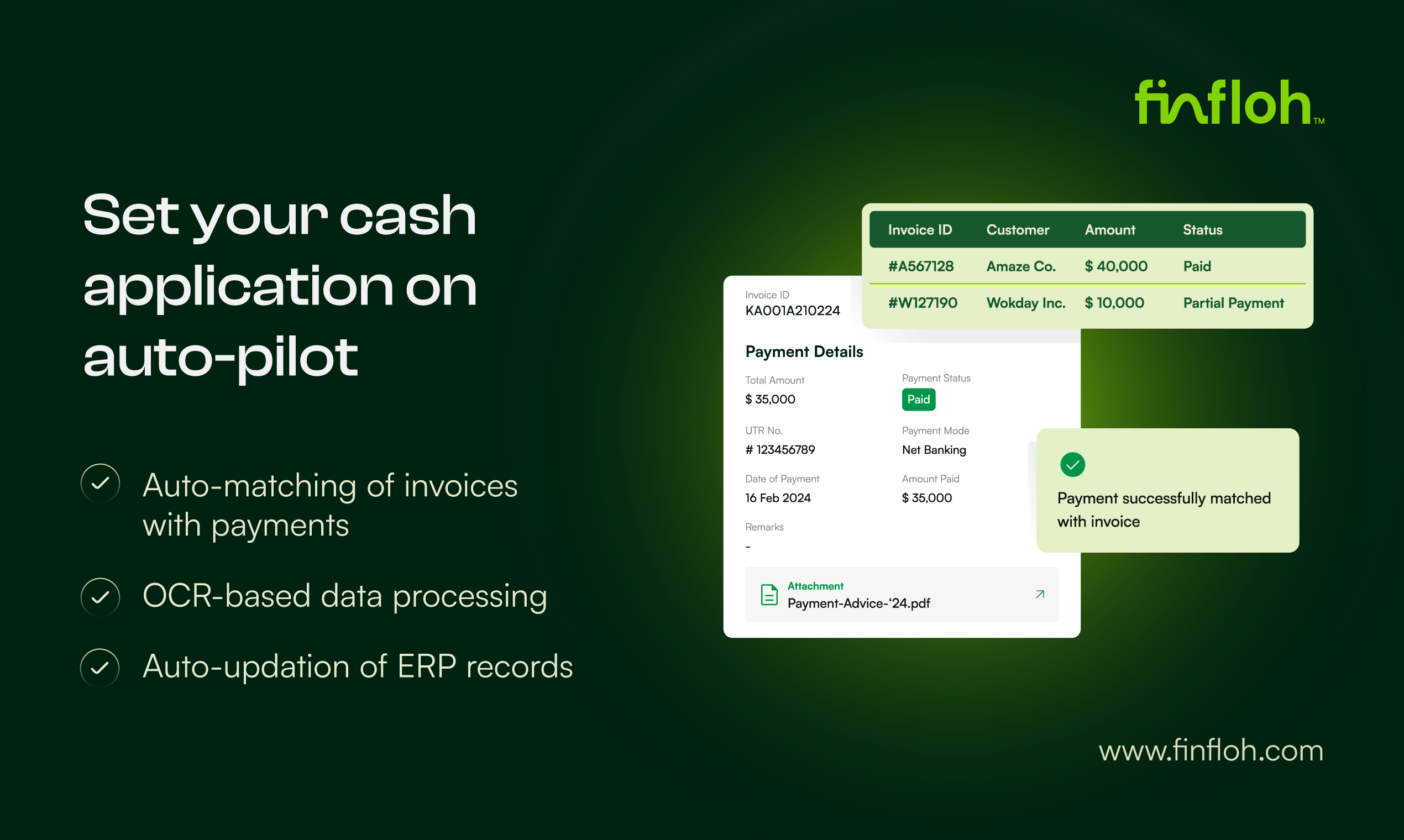

- 3

As a financial manager, I want to automate cash forecasting to accurately predict future cash flow

- 4

As an accounting professional, I want to automate invoice management to streamline the process

- 5

As a business owner, I want to automate collection follow-ups, cash application, cash forecasting, and invoice management to improve overall financial management.

![[object Object]](https://ph-files.imgix.net/5b23da45-2254-409b-82b7-8d93911b450d.gif?auto=format)